Credit card debt is one of the most common financial stresses in the USA. Interest grows quietly. Minimum payments feel manageable. Then one day the balance feels stuck.

A smart credit card debt payoff plan changes that story. It gives you structure, momentum, and emotional clarity. In 2026, with higher borrowing costs and tighter household budgets, strategy matters more than ever.

This guide walks you through a practical, step-by-step debt strategy USA households can realistically follow. We’ll compare the snowball vs avalanche method, explain the psychology behind success, and explore alternatives if you need extra support.

Nothing here promises instant results. This is about steady, repeatable progress.

Why a Smart Debt Strategy Matters in 2026

Credit cards charge some of the highest consumer interest rates. When balances linger, interest eats a large portion of each payment.

Without a clear strategy, people often:

- Pay randomly

- Lose motivation

- Add new debt

- Feel stuck

A smart system solves those problems. It gives direction and measurable wins.

The goal is not only to eliminate balances. The real win is building habits that prevent future debt cycles.

Step 1: Get a Clear Snapshot of Your Debt

Start with full visibility.

List every card:

- Current balance

- Interest rate

- Minimum payment

- Due date

Put everything in one document. A spreadsheet works fine.

This step removes uncertainty. You stop guessing and start managing. Many people feel immediate relief once they see the numbers clearly.

Clarity is the foundation of every effective credit card debt payoff plan.

Step 2: Stop the Debt From Growing

You cannot move forward if balances keep expanding.

Pause non-essential credit card spending. This does not mean extreme restriction. It means intentional choices.

Practical actions:

- Use debit or cash for daily spending

- Remove stored cards from apps

- Delay impulse purchases

This separates old debt from current behavior. It protects your progress before it begins

Step 3: Create a Small Financial Cushion

Unexpected expenses often push people back into debt.

A small emergency buffer prevents that setback.

Aim for:

- $500–$1,000 starter savings

or - One month of essential expenses

Keep this money accessible but separate from spending accounts.

This cushion protects your payoff plan when life gets unpredictable.

Step 4: Choose Your Core Payoff Method

This is where your debt strategy USA approach becomes focused. Two proven systems dominate personal finance because they work.

Snowball Method: Motivation First

With the snowball method, you pay off the smallest balance first while making minimum payments on others.

Once that card is gone, you roll the freed payment into the next smallest balance.

Why it works:

- Quick wins build confidence

- Progress feels visible

- Motivation increases

The psychological boost is powerful. Many people stick with the plan because they experience success early.

This method favors behavior over math.

Avalanche Method: Efficiency First

The avalanche method targets the highest interest rate first.

You still make minimum payments everywhere else. Extra money attacks the most expensive debt.

Why it works:

- Reduces total interest paid

- Speeds up long-term payoff

- Maximizes efficiency

This strategy appeals to people who focus on numbers and optimization.

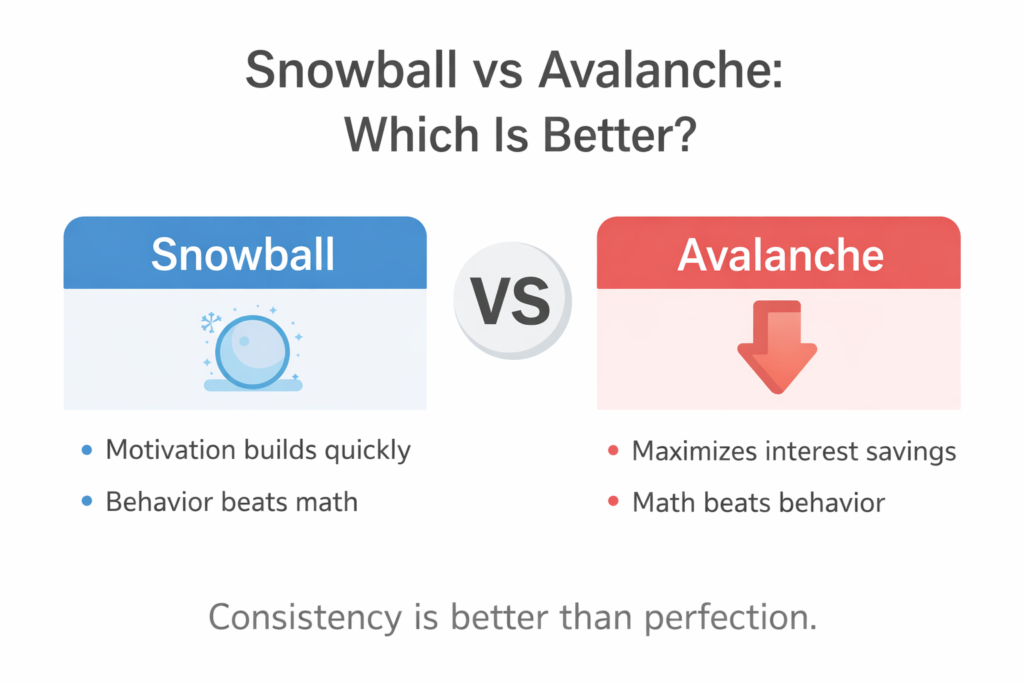

Snowball vs Avalanche: Which Is Better?

Both methods succeed. The best choice depends on your personality.

Choose snowball if you need emotional momentum.

Choose avalanche if you want mathematical efficiency.

Research and real-world experience show something important: consistency matters more than perfection. A method you follow beats a method you abandon.

Step 5: Automate Your Minimum Payments

Missed payments create fees and credit damage.

Set automatic payments for every card’s minimum due. Automation protects your credit while you focus on your chosen payoff target.

Then manually send extra payments to your priority balance.

This system reduces stress and human error.

Step 6: Free Up Cash Flow Without Burning Out

Debt payoff accelerates when you redirect money intentionally.

Look for realistic adjustments:

- Cancel unused subscriptions

- Reduce impulse spending

- Cook more meals at home

- Sell items you don’t use

You don’t need extreme sacrifice. The goal is sustainable redirection.

Even modest extra payments compound over time.

Step 7: Increase Income for Faster Progress

Expense cuts have limits. Income growth expands possibilities.

Consider:

- Freelance gigs

- Overtime shifts

- Skill-based side work

- Selling digital or physical goods

Treat extra income as debt fuel. Channel it directly into your payoff plan.

Think of this as a temporary sprint, not a permanent lifestyle.

Step 8: Use Psychology to Stay Consistent

Debt payoff is emotional as much as mathematical. Many plans fail because motivation fades.

Smart psychological strategies keep you engaged.

Track Visible Progress

Update balances monthly. Watching numbers drop reinforces effort.

Celebrate Small Wins

Paid off a card? Acknowledge it. Small rewards sustain momentum.

Focus on Systems, Not Willpower

Automation and routines reduce decision fatigue. You rely less on motivation and more on structure.

Avoid Comparison

Everyone’s timeline differs. Focus on your own progress.

Behavioral consistency drives successful credit card debt payoff more than perfect budgeting.

Step 9: Lower Interest When Possible

Interest slows momentum. Reducing it speeds results.

Call your credit card issuer and ask about:

- Rate reductions

- Hardship programs

- Promotional offers

Many lenders prefer working with proactive customers.

Lower interest means more of each payment hits the principal balance.

Step 10: Review Progress Monthly

Monthly check-ins keep your strategy aligned.

Ask yourself:

- Did balances shrink?

- Did spending stay controlled?

- Can extra funds be redirected?

Adjust when needed. A flexible plan survives real life better than a rigid one.

Alternatives If Your Debt Feels Overwhelming

Some situations require additional tools. These options can support or replace traditional payoff strategies.

Balance Transfer Cards

Move debt to a low or 0% intro interest card.

Best for disciplined payers who can clear balances before rates rise.

Debt Consolidation Loans

Combine balances into one fixed payment.

This simplifies management and may lower interest.

Approval depends on credit profile.

Credit Counseling Programs

Nonprofit agencies structure repayment plans with lenders.

They provide accountability and education.

Debt Settlement

Negotiates reduced balances.

This carries credit consequences and fees. It suits severe hardship situations.

Bankruptcy

A legal reset for overwhelming debt.

This option requires professional legal and financial advice.

Why This Smart Approach Works

A strong debt strategy USA households can rely on blends structure, psychology, and adaptability.

You:

- Gain full clarity

- Prevent new debt

- Choose a proven system

- Protect against setbacks

- Maintain motivation

- Adjust strategically

This layered approach addresses both numbers and behavior. That balance creates sustainable success.

Debt payoff is rarely about extreme sacrifice. It’s about intentional repetition.

Final Thoughts

Paying off credit card debt in 2026 does not require perfection. It requires a smart plan and consistent action.

Snowball or avalanche — both work when you commit. Psychological momentum matters as much as math.

Start with clarity. Build protection. Choose your strategy. Track progress. Stay patient.

Each payment reduces pressure. Each decision strengthens your financial foundation.

The smartest move is not waiting for the perfect moment. It’s starting now — and continuing tomorrow.