Personal loans rates can be useful when you need money fast. You might use one to cover medical bills, travel costs, or to consolidate high-interest debt. But the cost of borrowing — especially the interest rate — matters a lot. Lower rates save you money. Higher rates can make repayments expensive.

In early 2026, personal loan rates are still somewhat high compared with a few years ago. But there are still good deals if you know where to look and if your credit profile is strong.

What Are Personal Loan Rates?

When you borrow money from a bank or lender, you pay back the loan plus extra money. That extra is called interest.

The interest rate is usually shown as an APR (Annual Percentage Rate). APR includes the interest and some fees. A lower APR means lower total cost.

Your APR depends on:

- Your credit score

- Your income

- Loan amount

- Loan term (how long you take to repay)

If you have very good credit, you’ll get a better interest rate. If your credit is fair or poor, loans can be costly.

Current Personal Loan Rates (Feb 2026)

Here’s a snapshot of where personal loan rates stand this month.

Typical Average Rates

- Average APR in the U.S. is about 12.27% for a 3-year loan with good credit.

This means many borrowers will see rates around 12% — but individual offers can be lower or higher.

Lowest Possible Rates

Some lenders advertise lows under 7% if your credit score is excellent.

Examples of low advertised rates include:

- LightStream offers personal loan rates as low as 6.49% APR.

- Some lenders in daily rate lists show APRs starting below 7%.

Typical Range at Many Lenders

Depending on your profile and lender:

- Excellent credit: ~7% to ~12%

- Good credit: ~12% to ~18%

- Fair to poor credit: ~18% to ~36% or higher

This wide range shows how much personal rates vary based on who you are as a borrower.

Best Personal Loan Lenders (Typical Examples)

Below are common options many borrowers compare (U.S.-based examples — similar options exist in other countries too):

| Lender | Typical APR Range | Notes |

| LightStream | ~6.49% and up | Lower rates for very strong credit. |

| SoFi | ~8.7% and up | Competitive online lender. |

| Upgrade | ~7.7% and up | Good for fair to good credit. |

| LendingClub | ~6.5% and up | Broad ranges depending on score. |

| PenFed | ~9% and up | Credit union option. |

Remember: these ranges are not guarantees. Your actual rate could be higher or lower based on your credit history, income, loan size, and the lender’s pricing.

Why Rates Are Where They Are

Personal loan rates do not exist in a vacuum. They are shaped by broader money market conditions and economic trends.

In many countries, central banks set key interest rates. These influence what banks charge customers. If central bank rates are high, consumer loan rates tend to be high too. If central banks cut rates, we may see loan rates drop slowly over time.

In early 2026, some central banks have kept rates steady. This means many lenders are cautious in lowering rates further.

How to Get the Best Rate

If you want a lower personal loan interest rate, here are practical tips:

Check Your Credit Score

A higher credit score leads to lower APRs. Improve it by paying bills on time and reducing existing debts.

Pre-Qualify Without a Hard Pull

Many lenders let you check estimated rates without affecting your credit score. This helps you compare before applying.

Shorter Terms Can Help

Shorter loans usually have lower APRs than longer ones — but monthly payments are higher. Only choose shorter tenors if you can afford them.

Automatic Payments and Discounts

Some lenders offer small rate discounts if you enroll in autopay.

Compare Multiple Lenders

Don’t settle for the first offer. Shop around to see who gives the best deal.

Each of these steps can reduce your overall cost.

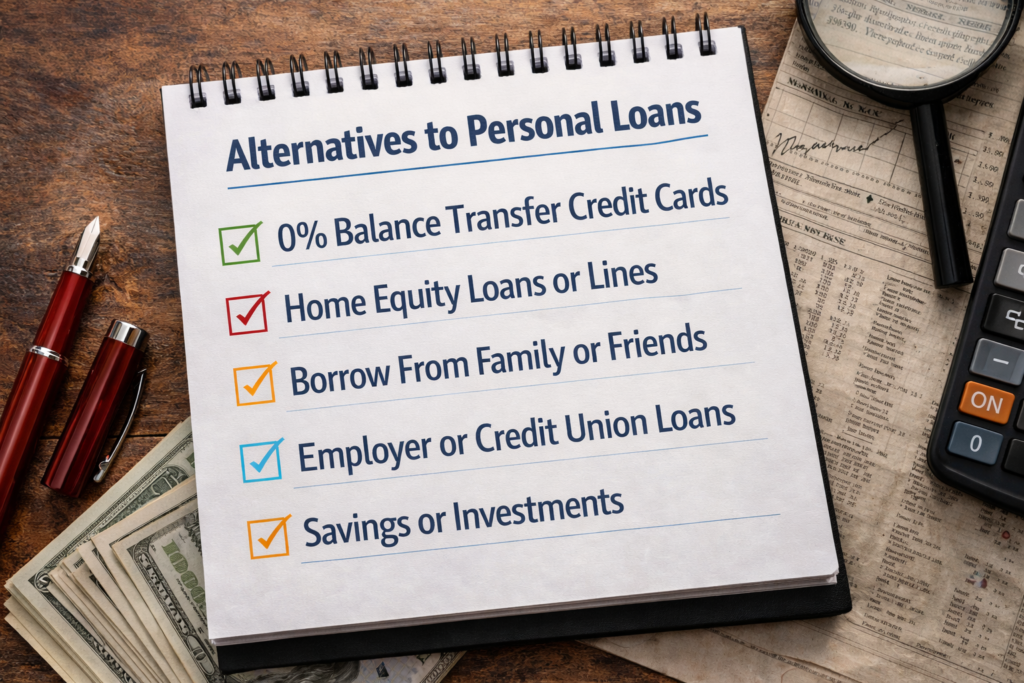

Alternatives to Personal Loans

Personal loans are not the only option for borrowing money. Depending on your needs, these may be better:

1. 0% Balance Transfer Credit Cards

If you want a short interest-free period (e.g., 12–18 months), a 0% card can be smart — especially for debt consolidation. But be careful: rates jump after the promotional period.

2. Home Equity Loans or Lines of Credit

If you own a home, a home equity line of credit (HELOC) or second mortgage often has lower interest rates than a personal loan. But your home is at risk if you default.

3. Borrow From Family or Friends

For smaller sums, borrowing informally could mean no interest. But it’s important to set clear terms so relationships aren’t strained.

4. Employer or Credit Union Loans

Some employers and credit unions offer lower-cost loans to members or staff. These may have simpler requirements.

5. Savings or Investments

It’s not ideal to touch emergency savings, but for planned spending, using your own money is almost always cheaper than borrowing.

Each alternative has pros and cons. Review costs, risks, and flexibility before deciding.

Is a Personal Loan Worth It Now?

Here’s the honest answer:

Yes — if you need money for a clear purpose and you can secure a reasonable rate.

Examples:

- Consolidating high-interest debt

- Funding medical bills

- Paying for emergency expenses

Maybe not — if you have poor credit and the rate offered is very high.

A high-interest personal loan can cost you more each month than you expect. In some cases, alternative options like credit unions, 0% cards, or structured repayment planning may cost less.

Always calculate the total cost of borrowing: monthly payments × number of months. This simple step shows you the real burden of the loan.

Final Thoughts

As of February 2026:

- Average personal loan rates are around 12% APR, but excellent borrowers can see rates below 7%.

- Rates vary widely by lender and borrower profile.

- Comparing options and knowing your credit score helps you find the best deal.

Personal loans are useful tools, but only when used responsibly. Always plan your repayment and borrow only what you truly need.